Refining and petrochemical companies are fighting on multiple fronts: low margins, volatile markets, aging assets, and the mounting pressure of the energy transition. For many, survival means making short-term fixes that only erode long-term competitiveness.

However, a different approach is possible. By shifting from defensive cost-cutting to proactive margin optimisation, operators can unlock hidden value in existing assets by stabilising cash flow today while funding the transition to a lower-carbon future.

“Cash Flow is the Biggest Challenge”

This pressure stems from three forces: 1. Extreme margin volatility, 2. Declining asset reliability and 3. The imperative of the energy transition.

“The single, biggest challenge facing refiners and petrochemical operators today is cash flow,” says John Koo, Business Development Director, Senior Strategic Business Planning Account Manager, APAC, Becht.

Aging equipment makes matters worse. “A single CDU or FCC trip can wipe out months of margin,” Koo warns. Yet, when cash is tight, companies often defer maintenance—locking themselves into a “short-term gain, long-term loss” cycle.

The way forward is moving from firefighting to margin optimisation. Unlocking zero- or low-capital value opportunities can steady cash flow, fund future initiatives, and build resilience.

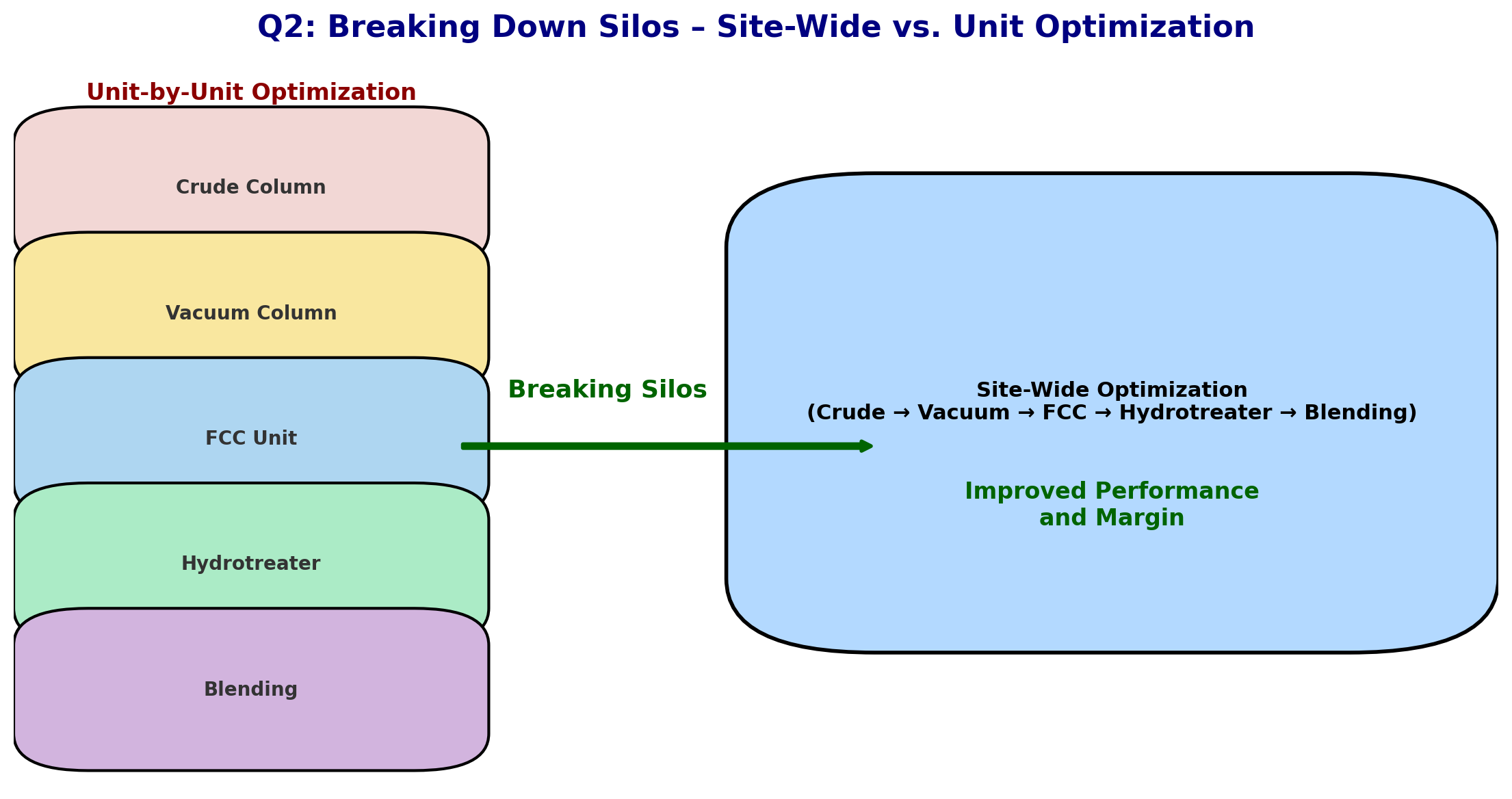

Breaking Down Silos

A refinery is a web of interconnected units: tweak one, and the ripple hits the rest. Too often, departments chase their own metrics, undermining overall profitability.

The fix is a site-wide optimisation mindset. Aligning planners, operators, and reliability teams around shared, enterprise-wide goals breaks down silos and exposes hidden value.

By adopting a site-wide perspective, all stakeholders, from planners to operators and reliability teams, are aligned around a shared goal. This collaborative model naturally breaks down internal barriers because teams must align around a shared, enterprise-wide objective instead of narrow departmental metrics. The impact is real. Koo witnessed a refiner uncovered USD 50 million per year in quick-win, no-investment opportunities simply by adopting this approach.

Leveraging Digital Tools for Faster, Smarter Decisions

Digitalisation accelerates this transformation, but only when combined with strong engineering and a holistic perspective. Modern tools give operators confidence to run closer to the economic optimum without compromising safety or reliability:

- Predictive Analytics for Crude Flexibility: Predicting how different crude blends will impact corrosion, allowing refiners to safely expand crude flexibility and avoid unplanned outages.

- Risk-Informed Planning: Tools that assess the fouling risks of blending streams give planners a clear, risk-informed picture before they commit to feedstock or blending decisions, preventing costly operational problems.

- AI and Machine Learning: Operating companies are applying artificial intelligence and machine learning techniques to “bad actor” pieces of equipment to help address root cause failures and meet on-stream availability, shifts the focus from fixing problems after the fact to preventing them in the first place.

These tools are not standalones. They reinforce the site-wide optimisation framework and give clients the confidence to push their assets while protecting reliability.

The Power of “Quick Wins”

Big capital projects may dominate headlines, but smaller, targeted actions can deliver immediate results in just three to six months. Examples include:

- Reducing Blending Giveaways: Save up to $8MM/year through octane giveaway reduction by tightening LP & scheduling models

- Optimising Stream Routing: Simple changes, such as routing a heavy naphtha stream to the distillate pool to take up flash point giveaway, can significantly boost the yield of higher-value products.

- Opportunity Crude Processing: Save$7.2MM/annual with a payback less than a quarter by Using CorrExpert on safely processed discounted crudes

The Energy Transition Roadmap

“Addressing these interdependencies is what makes the difference between a smooth transition and operational disruption.” – John Koo, Becht

The energy transition is reshaping refining into a dual challenge: continue providing fossil-derived products that the world still depends on, while progressively shifting toward renewable and low-carbon alternatives. Successfully navigating this shift requires a site-wide transition roadmap that integrates new processes without compromising the entire system.

This involves everything from carbon intensity benchmarking and co-processing renewable feeds to addressing the complex infrastructure challenges of handling both fossil and low-carbon streams. For example, co-processing bio-feeds in a hydrotreater can affect the entire refinery’s hydrogen balance, while introducing renewable naphtha has downstream blending implications.

Addressing these interdependencies, Koo states, “is what makes the difference between a smooth transition and operational disruption”. By combining technical expertise, proven methodologies, and digital tools, refiners can protect profitability today while preparing for tomorrow’s low-carbon reality.

About the Author

John Koo

Business Development Director, Senior Strategic Business Planning Account Manager, APAC

Becht

John Koo is the Business Development Director for Becht, Asia Pacific Operations, and Senior Strategic Business Planning Account Manager. John is a chemical engineering process technology consultant with more than 35 years of experience in the oil and gas sector, specialised in site wide margin improvement and overall refinery optimisation, feasibility studies, key accounts management, strategic business planning and simulation software sales. He has global project and business development experience in USA, Europe, South America, Middle East, and Asia. He is a Fellow Chartered Engineer with Institute of Chemical Engineers (UK).